Marriott Bonvoy® American Express® Credit Card

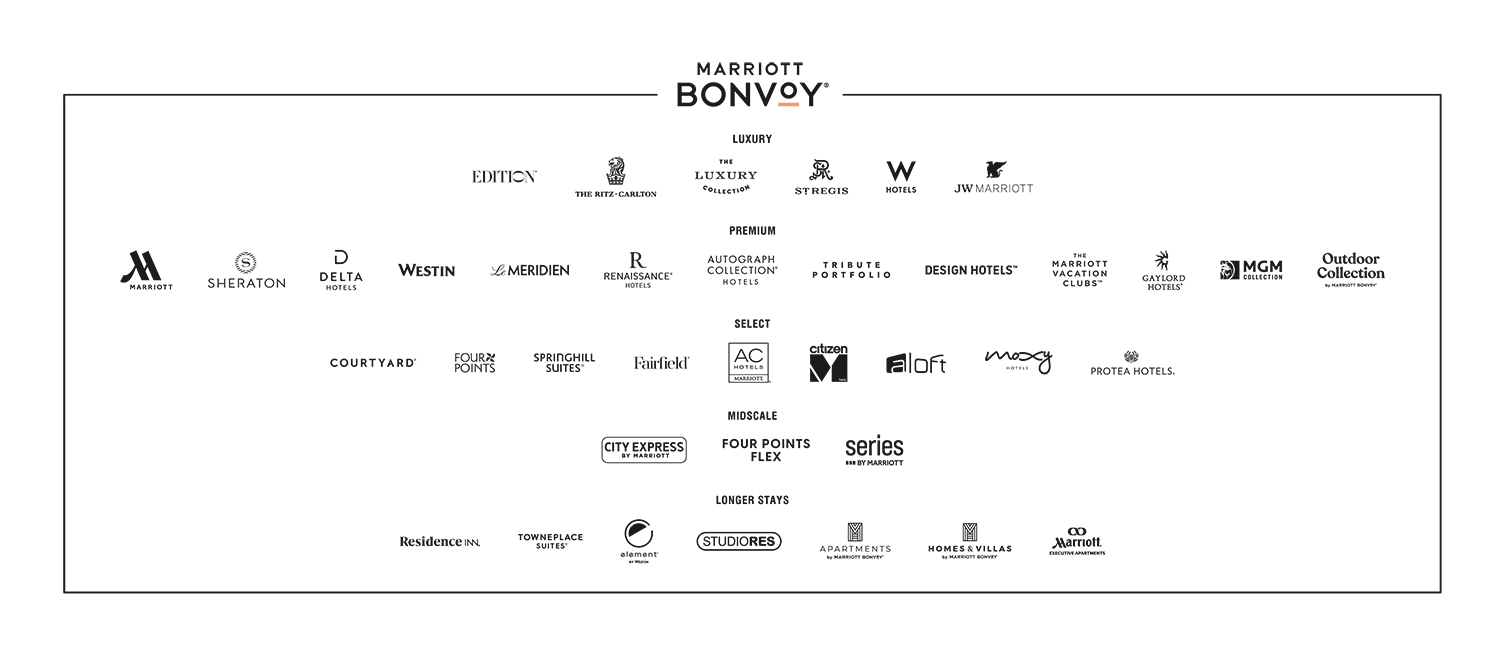

Enjoy exclusive benefits with the first hospitality Credit Card in the Kingdom of Saudi Arabia. Giving you access to more than 8,900 hotels worldwide across 30 extraordinary brands, the Marriott Bonvoy® American Express® Credit Card offers high exposure to global and local benefits and experiences.

KEY BENEFITS

30,000 Welcome Bonus Points

Earn points faster with every purchase and stay

per US$1 spent at hotels participating in the Marriott Bonvoy program.

per US$1 spent on international transactions other than Saudi Riyals and US Dollars.

per US$1 spent on transactions in US Dollars or its equivalent in Saudi Riyals.

0% Foreign exchange fees on Saudi Riyals

No exchange fees when you use the Marriott Bonvoy® American Express® Credit Card for spending in Saudi Riyals.

Where You Can Redeem

Hotels

Marriott Bonvoy MomentsTM

Frequent Flyer Programs

HEIGHTEN YOUR JOURNEYS WITH UNIQUE BENEFITS

US$100 Property Credit

To view full terms and conditions click here

Marriott Bonvoy Silver Elite Status Upgrade*

- 10% bonus points on stays

- Priority Late Checkout

- Member Rates and Free Wi-Fi

For more details about Marriott Bonvoy Silver Elite status please click here

Marriott Bonvoy Gold Elite Status Upgrade*

- 25% bonus points on stays

- Enhanced room upgrade

- 2pm Late Checkout

*If you qualify for higher Elite Status under the Marriott Bonvoy Loyalty Program Terms and Conditions, that qualification will take precedence.

For more details about Marriott Bonvoy Gold Elite Status please click here

15 Elite Night Credits

*Upon annual fee payment

Competitive Marriott Bonvoy points Expiration Date

CARD SERVICES

Supplementary Cards

Card Replacement

Online Account Access

Payment Convenience

Wide ATM Reach

Instant Notifications

Plan It™

LIFESTYLE BENEFITS

Access 1,200+ Airport Lounges with Priority Pass

Facilities vary in each lounge.

Unique Year-Round Offers

For Unique Year-Round Offers details please visit: https://www.emea.marriott.com/en/offers/ksa-amex

Amex offers

Annual free night Award

Certain hotels have resort fees.

*Upon annual fee payment

Fraud Protection

Travel Accident & Inconvenience Protection

FAQs

What is the Marriott Bonvoy American Express card, and how does it work?

The Marriott Bonvoy® American Express® Credit Card is the first hospitality credit card in Saudi Arabia, offering exclusive benefits like earning Marriott Bonvoy points on purchases, access to over 8,900 hotels worldwide, travel insurance, and airport lounge access. It allows you to unlock rewards and elite status upgrades through your daily spending.

What are the benefits of the Marriott Bonvoy Amex card?

The Marriott Bonvoy® American Express® Credit Card offers benefits like earning up to 5 points per USD spent, free Silver Elite status, a free annual night award, Priority Pass lounge access (2 free entries/year), travel protection, and 0% foreign exchange fees on Ʀ transactions.

How many Marriott Bonvoy points do I earn per dollar or Ʀ spent?

You earn 5 Marriott Bonvoy points per USD spent at Marriott Bonvoy hotels, 3 points per USD spent on international transactions (excluding Ʀ and USD), and 2 points per USD spent on transactions in Ʀ or USD.

Does the Marriott Bonvoy Amex card include airport lounge access?

Yes, the Marriott Bonvoy® American Express® Credit Card includes access to over 1,200 airport lounges worldwide through Priority Pass, with 2 free entries per year.

How can I redeem Marriott Bonvoy points earned with the Amex card?

You can redeem Marriott Bonvoy points for stays at over 8,900 hotels worldwide, exclusive Marriott Bonvoy Moments experiences, or transfer them to over 40 airline frequent flyer programs. Points can also be used for upgrades and other travel-related rewards.

- Non-compliance with the Terms and Conditions of American Express Saudi Arabia’s credit and charge Cards may result in cancellation/suspension of your Card/ Additional Cards without notice, legal escalation and a negative impact on your credit bureau record.

- Making only Minimum Payments on Your Credit Card may result in applying, charges and fees. For example if you have an outstanding balance of Ʀ 7,000 and you choose to pay only the minimum due, it will take 81 months to settle the balance in full. The total Murabaha Margin (term cost), in this case, would be Ʀ 6,296.

- Credit Card Purchase Rate is the Tawarruq margin of 2.75%

- Minimum payment is the higher value of 5% of outstanding balance or Ʀ 100 (for Saudi Riyals cards) or 50USD (for US Dollar cards).

- Annual Percentage Rate (APR) is starting from: 41.18% and for cash withdrawals 0%.

- The annual fees is 230 USD (including VAT).

- The price of the product/service may be affected by changes in the foreign exchange rate.

- American Express Saudi Arabia is regulated by the Saudi Central Bank.

- American Express Saudi Arabia Terms and Conditions apply and to view all Terms and Conditions, Card benefits, and fees, please visit www.americanexpress.com.sa/content/terms-and-conditions