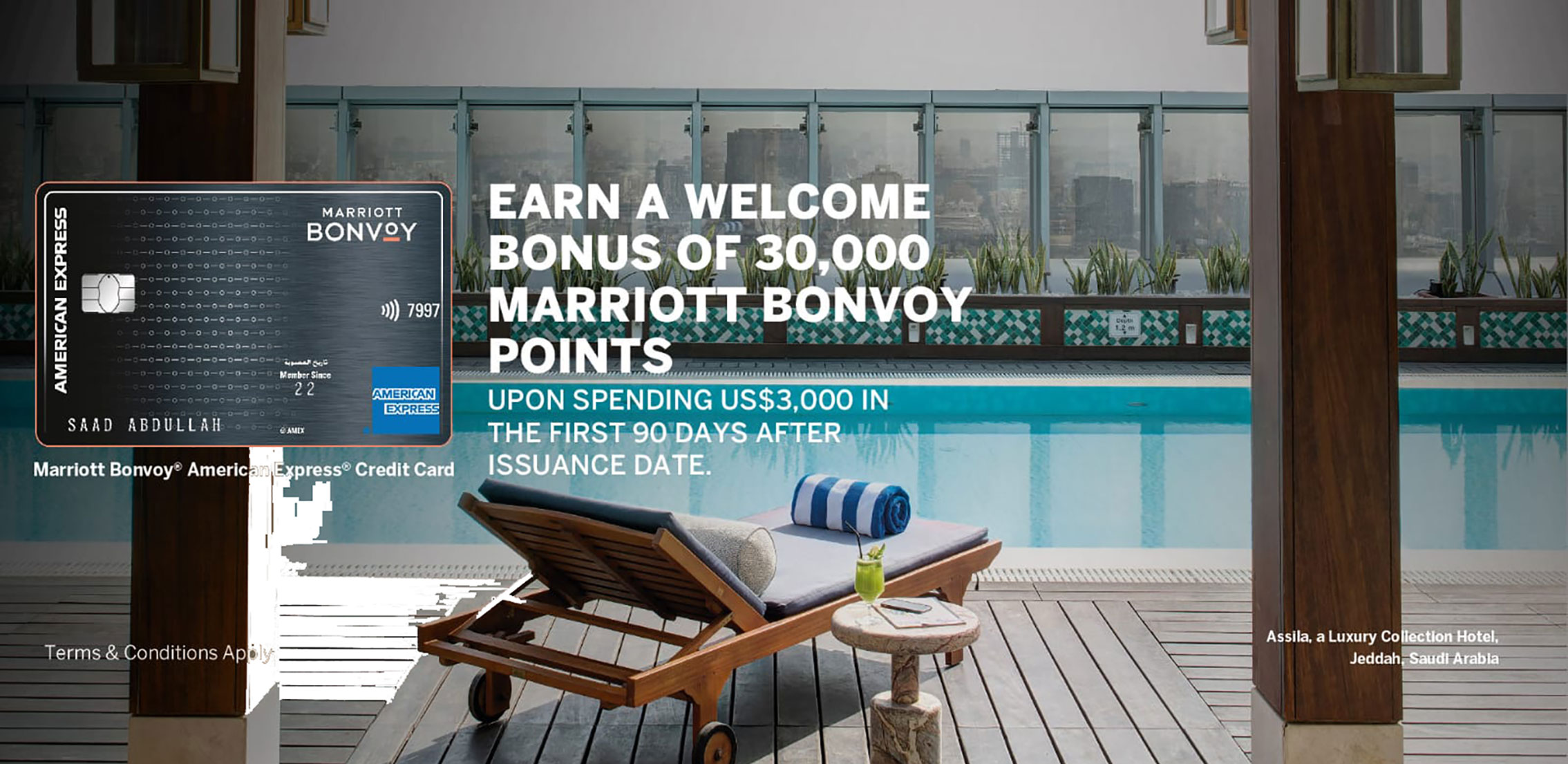

The Marriott Bonvoy® American Express® Credit Card

Key Benefits

How To Earn Membership Rewards Points

Key Information

Explore all Benefits

Marriott Bonvoy® Silver Elite Status Upgrade*

As a Marriott Bonvoy® American Express® Cardmember, enjoy an immediate upgrade to Marriott Bonvoy Silver Elite status and extras, such as:

- 10% bonus points on stays

- Priority Late Checkout

- Member Rates and Free Wi-Fi

* The tier upgrade benefit is only applicable to primary Cardmembers. If you qualify for higher Elite Status under the Marriott Bonvoy Loyalty Program Terms and Conditions, that qualification will take precedence.

For more details about Marriott Bonvoy® Silver Elite Status please visit: https://www.marriott.com/loyalty/member-benefits/silver.mi

Marriott Bonvoy® Gold Elite Status Upgrade*

The Marriott Bonvoy® American Express® Credit Card offers you Marriott Bonvoy Gold Elite status for one year, upon spending US$30,000 or more in eligible purchases on your Card. The Gold Elite status is retained when you spend US$30,000 or more annually with your Card and include benefits, such as:

- 25% bonus points on stays

- Enhanced room upgrade

- 2 PM Late Checkout

* The tier upgrade benefit is only applicable to primary Cardmembers. If you qualify for higher Elite Status under the Marriott Bonvoy Loyalty Program Terms and Conditions, that qualification will take precedence.

For more details about Marriott Bonvoy® Gold Elite Status please visit: https://www.marriott.com/loyalty/member-benefits/gold.mi

Access 1,200+ Airport Lounges with Priority Pass™

Your exclusive travel experience starts at the airport with a free Priority Pass Membership.

The Priority Pass Membership from American Express grants you access to over 1,200 airport lounges regionally and worldwide with a complementary membership upgrade. The Marriott Bonvoy® American Express® Credit Card offers 2-time free lounge entry per year.

Facilities vary in each lounge.

Travel Accident & Inconvenience Protection

Your peace of mind is an absolute priority any time you travel. The Marriott Bonvoy® American Express® Credit Card offers Travel Accident Protection with legal and medical assistance and Travel Inconvenience Protection against delayed flight departures,

flight cancellations, denied boarding, missed connections, luggage delays and luggage loss.

0% Foreign exchange fees on Saudi Riyals

No exchange fees when you use your Marriott Bonvoy® American Express® Credit Card for spending in Saudi Riyals.

Food & Beverage Discounts

Enjoy 20% off at participating restaurants and lounges across the Kingdom of Saudi Arabia when paying with the Marriott Bonvoy® American Express® Credit Card. For the list of participating venues visit www.morecravings.com/en/offers/amex-ksa

*Offer ends 31 October 2023.

Amex offers

Enjoy using your Marriott Bonvoy® American Express® Credit Card like never before with the new AMEX offers. Start saving instantly on your purchases when shopping at the places you love.

Wide ATM Reach

Cash is within easy reach no matter where you are. If you’re in Saudi Arabia, you can withdraw cash from any Saudi Investment Bank, SABB and Alinma Bank ATM. If you’re overseas, just use any of the 1.2 million ATMs with Express Cash™.

30,000 Marriott Bonvoy® Bonus Points

Earn a welcome bonus of 30,000 Marriott Bonvoy points upon spending US$3,000 in the first 90 days after issuance date. (New Cardmembers only)*

* Offer expires on June 30th 2023

Earn Bonvoy Points*

Earn Faster with your everyday purchases.

5 Marriott Bonvoy® Points per $1 spent at hotels participating in the Marriott Bonvoy® program.

3 Marriott Bonvoy® Points per $1 spent on international transaction other than Saudi Riyals and US Dollars.

2 Marriott Bonvoy® Points per $1 spent on transactions in US Dollars or its equivalent in Saudi Riyals.

* All earned points will be credited to your Marriott Bonvoy® account in the monthly statement.

Competitive Marriott Bonvoy® Points Expiration Date

Jet-set with peace of mind. Your Marriott Bonvoy points don't expire if your Marriott Bonvoy account has a Qualifying Activity for 24 consecutive months.

US$100 Property Credit

Receive a US$100 credit for in-hotel qualifying purchases during a paid stay of two nights or more at The Ritz-Carlton® and St. Regis® hotels when you book direct using a special rate for a 2-night minimum stay using your Card. Terms apply.

To view full terms and conditions click here

15 Elite Night Credits

Each calendar year, you can receive 15 Elite Night Credits towards the next level of Marriott Bonvoy Elite status*. Limitations apply per Marriott Bonvoy member account. These can be used toward attaining the next Elite status in the Marriott Bonvoy Program.

* Upon annual fee payment

Conditions apply.

Annual free night stay

Receive 1 Free Night Award as a welcome gift and 1 more every year after your Card account

anniversary*.

* Upon annual fee payment

Unique Year-Round Offers

Enjoy unique offers around the year when using your Marriott Bonvoy® American Express® Credit Card.

For Unique Year-Round Offers details please visit: www.americanexpress.com.sa

Fraud Protection

Your Marriott Bonvoy® American Express® Credit Card is fraud-proof with Retail Protection, everything you buy with your Card is protected for 90 days against theft, loss, or damage. In addition, Online Fraud Protection Guarantee means that your online purchase is 100% risk free, so you will never be subjected to any unauthorized charges.

Instant Notifications

Your Card is protected against unauthorized or fraudulent attempts. Every time you use it, even with declined attempts, you will receive an instant SMS and email as confirmation and reassurance.

Online Account Access

You can keep your eyes on your Card account at all times. Login to check your credit limit, balance, statements, outstanding bill amount, your next billing date, and transactions over the past 12 months.

Card Replacement

Worrying about a lost or stolen Card is a thing of the past. If your Card is lost or stolen, we’ll send you a Replacement Card as quickly as we can, almost within 5 to 10 business days.

Payment Convenience.

Your due balances are no longer a burden. Pay them off in whatever way you prefer: ATMs, via phone or the internet with the quick and convenient SADAD service, Direct Debit or SARIE Bank Transfer.

Supplementary Cards

Benefits are even better when shared with your family members (of ages 15+), so grant them the joy of Supplementary Cards (Annual fee US$100).

- Non-compliance with the Terms and Conditions of American Express Saudi Arabia’s credit and charge Cards may result in cancellation/suspension of your Card/ Additional Cards without notice, legal escalation and a negative impact on your credit bureau record.

- Making only Minimum Payments on Your Credit Card may result in applying, charges and fees. For example if you have an outstanding balance of Ʀ 7,000 and you choose to pay only the minimum due, it will take 81 months to settle the balance in full. The total Murabaha Margin (term cost), in this case, would be Ʀ 6,296.

- Credit Card Purchase Rate is the Tawarruq margin of 2.75%

- Minimum payment is the higher value of 5% of outstanding balance or Ʀ 100 (for Saudi Riyals cards) or 50USD (for US Dollar cards).

- Annual Profit Rate (APR) for purchases is 33% and for cash withdrawals 0%.

* To view the full list of Card Terms and Conditions, click on this link

https://www.americanexpress.com.sa/termsandconditions

*** Eligibility Criteria Apply: Have a monthly income of Ʀ 25,000.

Documents and information to have ready:

- Latest 3 Months Bank Statement

- Salary Certificate